Homebuyers Rights or Protection Laws

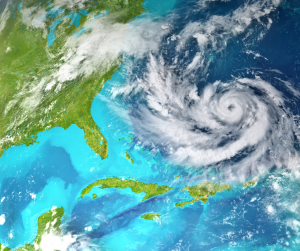

If you are buying a home in Florida, you may be wondering how a hurricane could impact your real estate transaction. Since we just had hurricane Ian blow through Florida, I figured I should talk a bit about what the home buyers rights and protection law are in a residential sales contract.

Home Purchases and Hurricanes

Before moving to Florida, you should consider the potential of a hurricane, tropical storm, or other major weather event. These events may impact not only the process of your purchase but also the integrity of the property.

The first thing to keep in mind is, while a natural disaster can hit any home, in any area, at practically any time, we do have a routine “Hurricane Season”. This season lasts from June 1 through November 30. While this is a pretty wide range, we typically see the worst of any storms around September. If you are flexible in your timeline for moving, you might want to plan your home search outside of the hurricane season.

If you are working within the season, don’t worry… Florida real estate law takes into consideration the possibility of a natural event causing disruption. All contracts will include homebuyers’ rights and protection laws to protect you in case the property is damaged during the transaction period.

One of the most popular contracts we use here in Northeast Florida is the AS IS contract. I’m going to share some of the clauses in that contract which pertain to these potential casualties.

Force Majeure Clause

The first clause we’re going to discuss is Force Majeure. Which is defined as an event that cannot be reasonably anticipated or controlled. In real estate this can include extreme weather, like hurricanes, an act of war or terrorism; summed up as any unpreventable disruption of routine business. This now also includes epidemics, pandemics, and government shutdowns.

In the As-Is contract, this clause first comes into play as an automatic extension of contingencies and deadlines “when a dramatic event prevents a party’s performance or closing from happening”.

Once the clause is triggered, certain time periods within your contract such as inspection, financing and the closing date will be extended for a reasonable amount of time. Or up to 7 days after the force Majeure event no longer prevents the performance of the contract.

A key provision in this clause to pay attention to is the timeline to the closing date. In the event this clause takes effect, either party may terminate the contract. In order to do this, a written notice must be delivered when Force Majeure continues to prevent performance of the contract for more than 30 days beyond the original closing date.

Risk of Loss Clause

When property is damaged by fire, hurricane, or other casualty, the Risk of Loss clause goes into effect. This describes the rights and obligations of each party. Whereas Force Majeure provides the guidelines for timing, the Risk of Loss clause deals with money (funds) and the responsibilities to take action.

Here is an example; If the property sustains damage, and the cost to restore the property does not exceed 1.5% of the purchase price then the cost will be the seller’s obligation. In a hurricane, this could include the cost to prune or remove damaged trees, remediation for water intrusion, and repair roof damage.

In the event that the restoration isn’t complete prior to closing, the seller owes an obligation to the seller. They will have to escrow a sum equal to 125% of the estimated cost to complete the restoration or repair. When the cost of restoration exceeds 1.5% of the purchase price, then the buyer has 2 options. Either take the property “as is” along with that 1.5% of the purchase price or cancel the contract altogether. Thereby releasing both the buyer and seller from all further obligations. If the buyer chooses to terminate the contract, they will receive a refund of their escrow deposit. If the buyer does not exercise the right to cancel within the prescribed time frame, the clause assumes that they will continue with the purchase.

Note: other contracts may vary on the prescribed timeframes or budgets. In NEFAR, for example, the Risk of Loss restoration budget is up to 3% of the purchase price.

Understand Your Rights

It’s important for you to understand, as a homebuyer, that there are homebuyers’ rights and protection laws in place on your purchase contract. Especially if you are buying in an area that has routine natural events such as hurricanes, wildfires, and earthquakes. If you have any concerns about the possibility of Force Majeure or Risk of Loss, ask your agent to explain those clauses to you before you sign anything.

As always, if you are purchasing a home in NE Florida and need some assistance, feel free to reach out to me at any time. Click this link to schedule a call!