2023 FLORIDA HOUSING MARKET

The Northeast Florida Spring Housing Market is here, and buyers are showing more activity, although some are still hesitant, waiting to see what happens. In this blog post, we will take a closer look at the local real estate market’s March stats and see what’s happening.

Let’s start by examining the broader Florida real estate market. Rising mortgage rates had a considerable impact on the real estate market last year, and Florida was no exception. Sales activity slowed down, and closed sales of existing single-family homes dropped almost 33% year-over-year in January 2023.

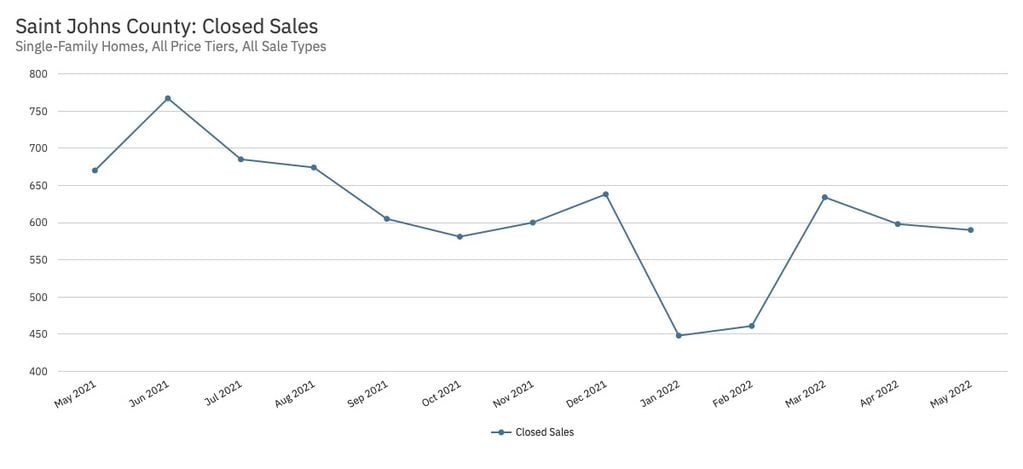

Although the 30-year fixed mortgage rate has come down since its recent peak in November, it still remains high, ranging from 6 to 7% over the past four months. This consistency in rates is resulting in homebuyers feeling more confident in moving forward with their purchase. We are seeing more activity now than in the fall months and earlier this year. However, sales levels still remain low relative to last year. In St. Johns County, closed sales in March for existing single-family homes fell by 20.2% from 634 to 506.

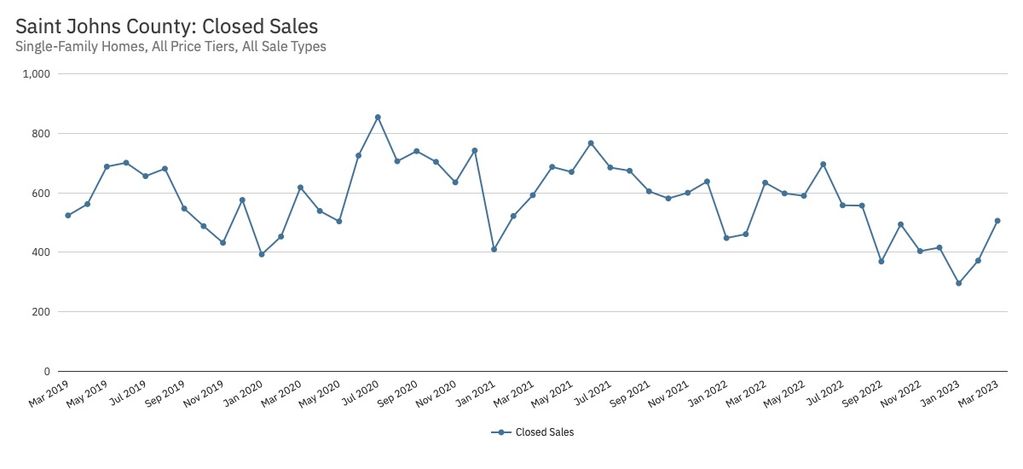

It’s important to note that we started to see demand weaken last year as rates continued to rise. The decline in closed sales began last spring, carrying through the summer and the end of the year when rates were near 7%. As we continue into this year, we will likely see sales improve with more inventory, but instead of comparing it to last year, when the increase in rates brought down housing demand, let’s use 2019 as a benchmark since it’s our last pre-pandemic year. Sales in March 2019 were 524, while in March this year, they were 506, only about a 3.5% difference. Thus, sales are trending closely with the pre-pandemic market.

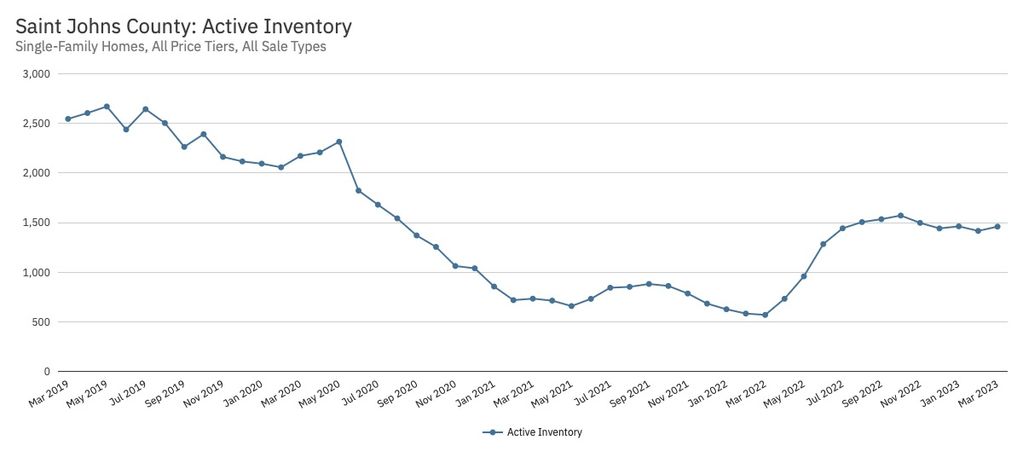

When it comes to Single Family homes in St. Johns County, inventory is still a major issue. Although we are up 156% from a year ago with 1459 active properties, we are still well below the pre-pandemic levels from 2019 when we had over 2500. It’ll be interesting to watch these numbers to see if the 2023 market begins to mirror 2019 as more inventory comes on.

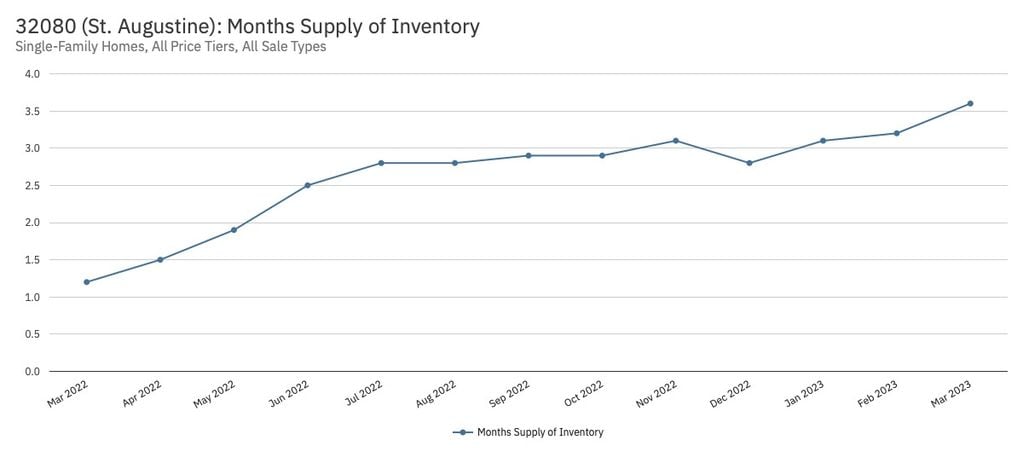

Despite the increase in inventory, the low supply has helped slow appreciation in the last year, which is good news for homebuyers. However, we have not seen a reversal in prices, as some may have expected. The only way we can start to see prices decrease is with more inventory, so as long as supply stays low (currently at 3 months), prices are unlikely to decrease significantly.

In St. Johns County, the median price for single-family home sales in March was $542,545, only down 1.4% from a year ago. As for townhomes and condos, the median sales price rose 9.6% to $330,000.

It’s important to understand that the real estate market is very local. Depending on where you are searching for a home, you may see multiple offers in one area and price reductions in another. In St. Johns County, for instance, my own buyers and sellers are experiencing a bit of both. Some are looking for a specific size home over 3000 square feet with 5 bedrooms and a pool, which are difficult to find. When these homes come on the market, they are getting multiple offers, mainly in the North and West sections of the county. If you take it hyper-local to a specific community, where there are many buyers wanting a certain community but no inventory, you can bet there will be multiple offers when a property comes on the market.

In comparison, on Anastasia Island, I am seeing more price reductions and homes sitting longer. This could be for a variety of reasons, such as concerns about being too close to the coast and higher insurance premiums. A second home buyer looking for a getaway on the beach can take their time, while a young family looking to buy in the top school districts will move faster to be settled in before the new school year. There are many variables that affect the hyper-local markets.

If you are looking to sell or buy a home, it’s important to understand that the broader statistics for the county may not pertain to the specific area you are searching in or selling your home in. So stay informed and keep an eye on the local market data to make informed decisions.

While the Florida real estate market, like every other state, has faced some challenges over the past year, there are also signs of improvement. There are opportunities for buyers to request seller concessions or repairs. The fall market was a great market for these types of incentives, but many buyers held off due to rates and were waiting for some form of a crash. However, it’s unlikely that we will see one anytime soon in this area, so don’t let the rates stop you from purchasing a home. We can’t predict where the prices will be in a year, and you can always refinance in the future.

With that being said, the Spring market has historically been peak pricing, so if you can wait until summer or fall, you will typically find better pricing and less buyer competition, but usually less inventory.

If you want to know what the value of your home is in the current market or are looking to purchase with concessions, feel free to reach out. Of course, I am here to help.

To summarize, the Spring housing market has arrived in Northeast Florida, and while there is more buyer activity, some are still waiting to see what will happen. Sales levels remain low compared to last year, but they are trending closely with the pre-pandemic market. Inventory is still a major issue, and while increases have helped slow appreciation, we have not seen a reversal in prices. The real estate market is very local, so be sure to stay informed about the local market data and hook up with a local Realtor who knows their market to assist you. There are opportunities for buyers to request concessions or repairs, and although the Spring market has historically been peak pricing, waiting until summer or fall may lead to better pricing and less buyer competition, but usually less inventory.