Are we in a Housing Bubble?

Will house prices go down in 2022, well that’s what we are talking about today so let’s get to it?

Hi Everyone, Thanks for joining me. I’m Kim Devlin Welcome to my channel Your Key to St Augustine where I talk all things St Augustine, St Johns County and Real Estate.

Everyone is asking me if we are in a bubble and when the prices are going to become more affordable so I thought I’d do a market update since it’s been a few months. Now first off I do not feel we are in a bubble this a supply and demand issue but I do feel we will balance out a bit in 2022.

We are still very much in a sellers market since the inventory in St Johns country remains low at 1.3 months but this time of year we usually see a lull. However we are seeing some changes since the Spring.

So here’s what I am seeing locally. Homes are staying on the market longer than a day. Of course this will be price dependent as well. For example a home priced under $350k may go faster than a home priced at $650k because its hotter price point.

What I am not seeing is the clause Highest and Best by a certain time in the listing descriptions, as I did in the Spring, so my guesstimate would be that the homes are either priced to high or buyer interest has wained a bit.

and lastly, I am seeing homes coming back on the market after being under contract, which could mean either something came up in the inspection or the home did not meet appraisal for the loan approval. So are we seeing some sort of decline in the market stats?

Well let’s go back to the Spring months specifically May and June. When a listing came on the market, there were multiple offers with many homes going for over the list price.

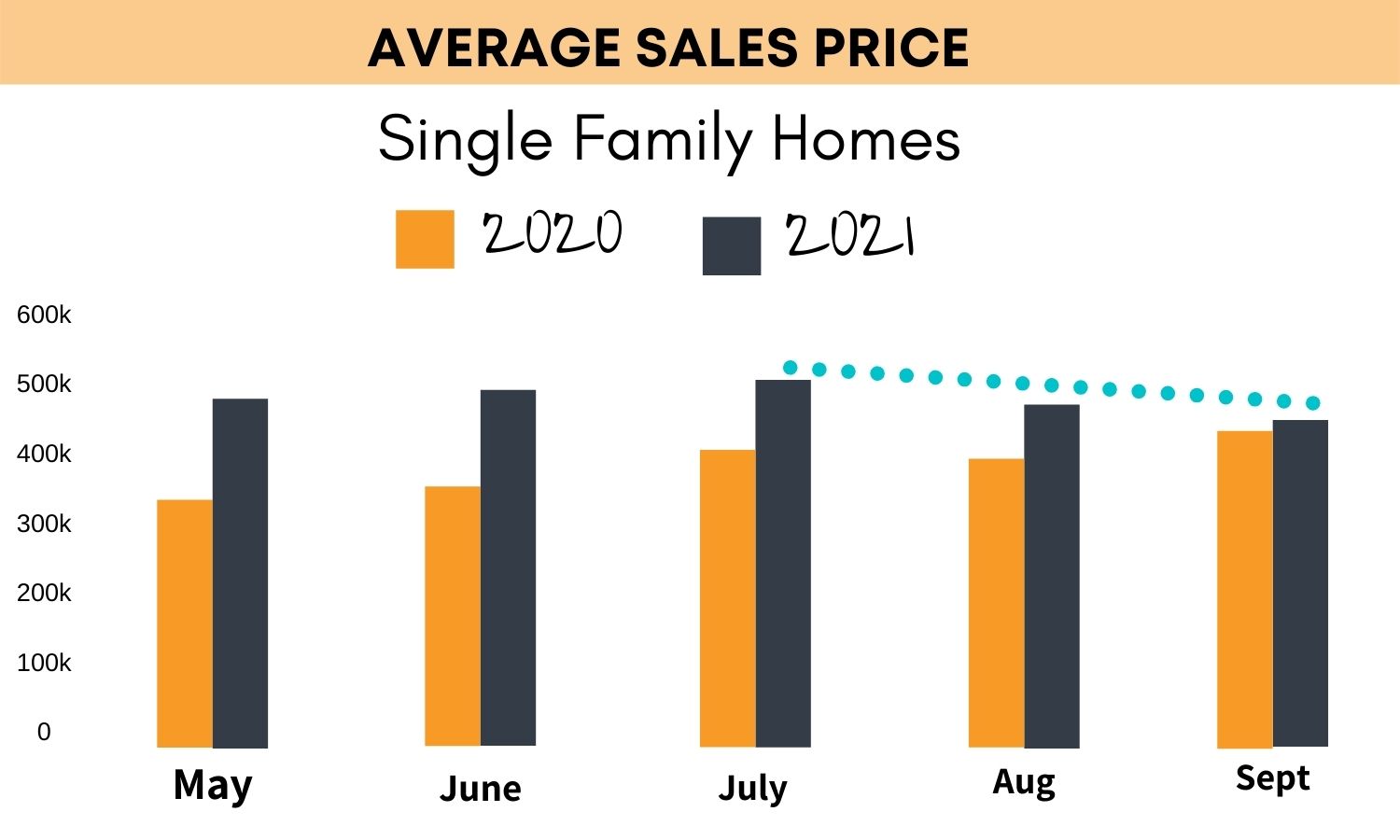

When we compare the Spring of 2020 to this year we saw 167 homes that sold in May 2020 with an average sale price of $351,000 while this year in May we saw 202 sales with an average sale price of $481,000. That is a 37% year to year increase

Now let’s look at June in 2020, we saw 230 homes sold with an Average Sale price of $365,000 and this year we saw 217 sales with an average sale price of $499k which is on par with May at a 37% year to year increase.

so needless to say the Spring of 2021 had been a crazy one but that is not news to anyone. We saw multiple offers over asking, homes going under contract quickly and a lot of frustrated home buyers. Most buyers were priced out and many decided to hold off until the market changes. With what I am seeing locally now, I’m hoping we are headed in that direction.

When we look at the stats for July and August. In July we saw 208 sales and an average sale price of $551k, a 24% increase from last year and in August with 238 sales we saw an average price of $474,000 an 18% increase from last year’s average sale price of $401k. Now summer tends to be slower especially once the school year starts so let’s look at the first two weeks of September because this is where we are seeing number comparable to last year.

In 2020 we saw 107 sales with an average sale price of $445k while this year we saw 82 sales so a lower number of homes but an average sale price of $449k, so not much difference in the average sale price with only a .8% so with only this slight change from last year in September, homes coming back on the market, buyers not waiving appraisals and days on market beginning to increase can this be a sign that things are beginning to balancing out. I certainly hope so.

According to Florida Realtors in the state of Florida as a whole the increase in single family homes went up a fraction of a percentage point in August vs condos which were up 13% year over year. could this be a sign that the single family home market is balancing out a bit?

We’re still very deep into a seller’s market and it will be a long road back to a balanced market but we may just be headed there for 2022.

Well I know that was a lot of information so click the link below for details from this videos and some charts to refer to.

If you have any questions, feel free to reach out. Thanks so much for tuning in and I will catch you on the next one.