Housing Market Predictions

In a world where headlines about the housing market often, it’s crucial to delve into the actual data. In this blog, we’re breaking down the latest national and local trends in Florida, focusing on inventory, interest rates, and their implications for buyers and sellers in our Housing Market 2024 Prediction.

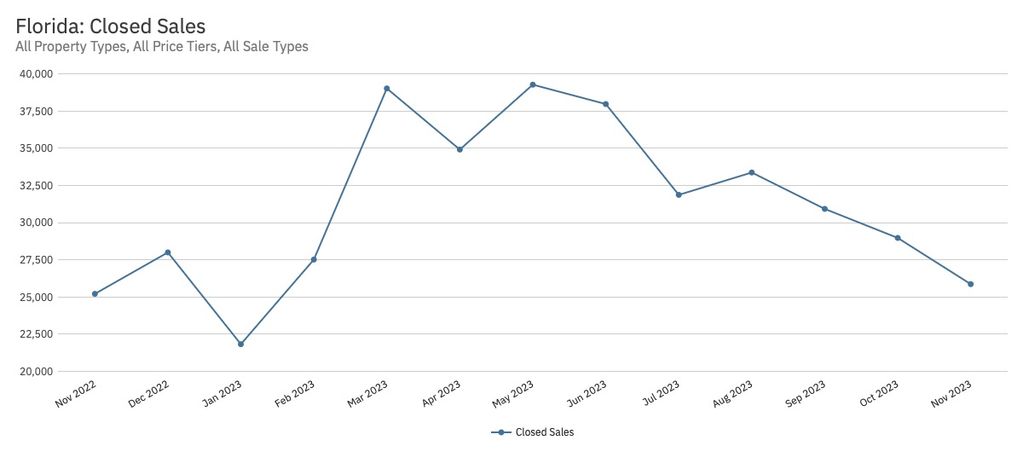

National Market Overview: 2023 has been a year of significant changes in the real estate market. Interest rates have risen sharply, contributing to a 4th quarter decline in sales both nationally and in Florida. Despite this, home prices have shown remarkable resilience, underpinned by a persistent housing unit shortage. This scarcity is a key factor in maintaining higher home prices.

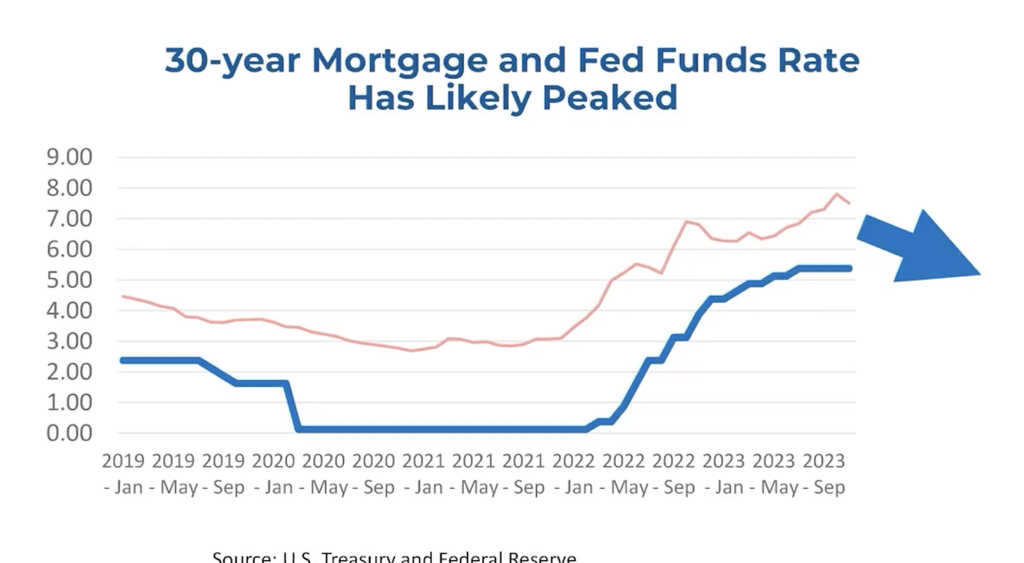

Affordability is a growing concern. The leap in interest rates from 2.65% to 8% over two years has sent shockwaves through the industry.

Economically, we’re seeing a slowdown, however inflation still sits above the Federal Reserve’s 2% target. This suggests a possible delay in rate reductions, potentially not occurring until mid-2024.

Housing Market Predictions for 2024

Many experts anticipate that 2024 will mirror 2023 in sales volume. However, some predict mid-year rate cuts, leading to a strong end to the year. This optimism is partly driven by the bond market’s anticipation of Federal Reserve rate cuts, potentially up to three or four times in 2024.

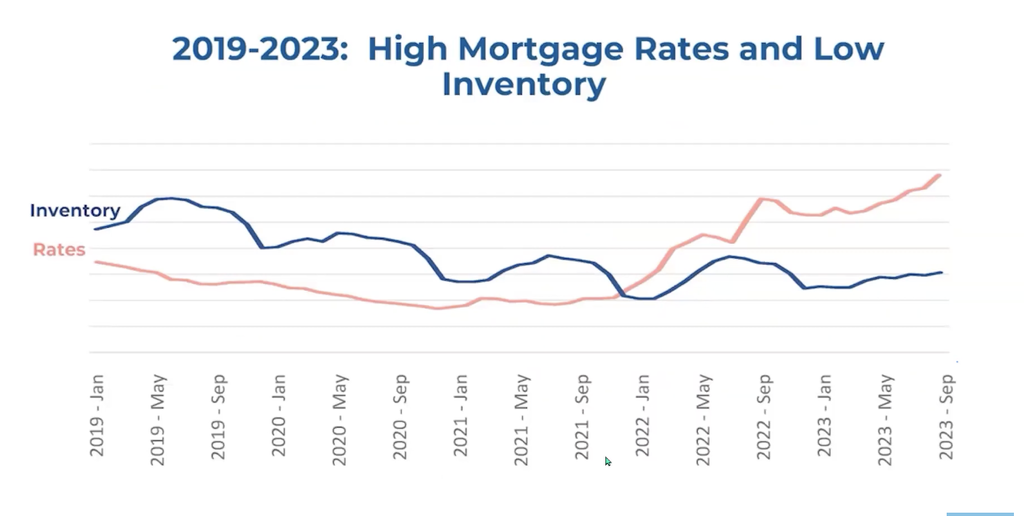

The Inventory Issue: Contrary to some predictions of a housing market crash, current data doesn’t support a surge in foreclosures or a drastic increase in inventory levels. With low unemployment and continued home value appreciation, we’re not seeing signs pointing to either scenario.

New construction has been a significant contributor to housing inventory. Builders are not only creating more homes but also enticing buyers with attractive mortgage rate buy downs.

Buyer and Seller Strategies: For buyers, lower rates may mean more competition and less choice. Sellers are now more in tune with market realities, adjusting their pricing strategies to align with higher interest rates, which is helping drive sales.

Florida Housing Market Snapshot:

In Florida, we’ve seen an uptick in sales despite the rate increases. New listings, particularly in the single-family home and townhouse/condo sectors, have increased, bringing more options for buyers.

Despite the inventory growth, median prices continue to rise, indicating sustained demand.

Despite the inventory growth, median prices continue to rise, indicating sustained demand.

In St. Johns County, while the median sale price of single-family homes has slightly decreased, sales activity remains robust. The county’s inventory is up to 4 months and has been driven by new construction.

Insert relevant St. Johns County charts

2024 Outlook: As we look ahead, the key factors to watch are interest rates and inventory. Lower rates could stimulate seller activity and intensify competition among buyers.

Conclusion: Real estate markets are highly localized. Whether you’re relocating to St. Johns or Flagler County or competing with new construction in your neighborhood, understanding the specific dynamics of your area is essential. Stay informed, and don’t hesitate to reach out for personalized advice and insights.

For more questions contact the Kim Devlin, St Augustine Realtor…Click Here